This blog series will delve further into the findings of the white paper and will also consider some wider questions. It is hoped that these insights will be useful in throwing some light on the evolving needs and preferences of an increasingly multigenerational travelling workforce.

Situ recently published a white paper, Mind the Gap: Generational analysis of the accommodation requirements and behaviours of today’s business travellers. The paper presented the key results of a combined research study comprised a survey conducted by YouGov1 and a series of interviews with senior corporate travel managers and specialists. It explored the increasingly diverse expectations, behaviours, and preferences across four generational cohorts of business travellers: Gen Z, Millennials, Gen X, and Baby Boomers.

This insights piece will explore trends in the degree of flexibility different generations demand when choosing accommodation for their business travel. In the same way, we then explore booking behaviours of the four different generations and the stark differences between Gen Z and travellers of other ages.

Contents

- Flexibility in accommodation choice

- Booking behaviours – how travellers are booking their accommodation

Want to learn more? We hosted a webinar that delved into the key insights we uncovered in the white paper – with some of our interviewees as guests.

Flexibility in accommodation choice

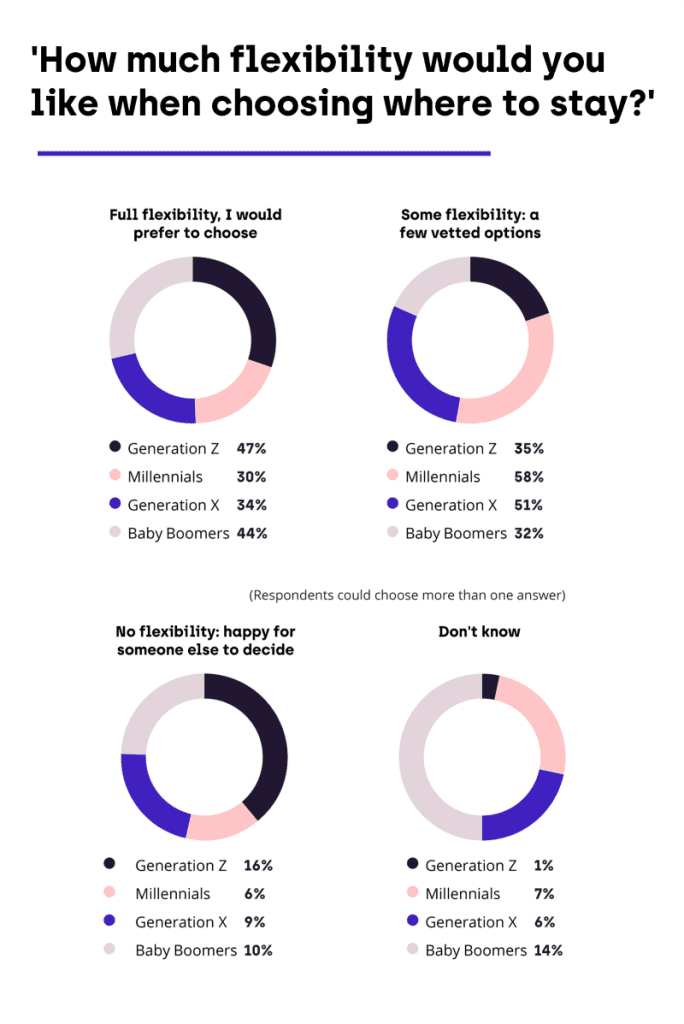

When asked, ‘How much flexibility would you like when choosing where to stay?’ more respondents from the upper and lower age ranges – Gen Z and Baby Boomers – wanted total flexibility in choice of accommodation, with less Millennial respondents saying they wanted full flexibility.

Those wanting ‘some flexibility’ and to choose from ‘a few vetted options’ were mostly from the middle generations of Millennials and Gen X.

Wellbeing considerations seem to be a key factor here. Interviewees mentioned that younger employees want options that allow them to take bikes, or to stay in locations near friends; while older generations often want to take family members on their trip, particularly if it is long or crosses major holidays.

“Employees ask to bring family members with them on longer term assignments or on extended travel that crosses major holidays – the ‘blended not extended’ business stay!”

Ailsa Pollard, Central Procurement, Senior Buyer, Murphy Group

One anomaly was that a higher percentage of Gen Z respondents than other generations (16%) were happy for someone else to choose for them – this warrants further investigation. Our interviewees provided possible insights for this variability in the survey data, even within a generation. In some sectors, Gen Z employees are travelling to rural areas for fieldwork and construction – and in these places neither Gen Z (nor any other generation) would necessarily want, or be able to, choose where to stay since options are fewer than in a busy urban hub.

Allowing employees flexibility when choosing their accommodation for a business trip can be a good tool for increasing employee wellbeing and morale, but this must be balanced by considerations around duty of care, for example when there is a desire to stay in an STR that may not be of good quality or compliant with safety rules.

The impact of company culture

But what may be hidden within the generational view is that traveller expectation of increased flexibility in accommodation choice and personal agency (and a willingness to express this) is also likely to be influenced by company culture. This idea was highlighted by Sue Jones, who points out that companies that encourage their people to challenge the status quo in their work may find employees have higher expectations for individualised travel compared to those working in a highly regulated sector, such as finance.

“The culture of a company may determine how much flexibility employees expect, and are given, when they travel for work. A good travel policy will align with company culture, while also carefully balancing compliance and duty of care.”

Sue Jones, Institute of Travel Management (ITM) Member

Travel managers must sometimes explain why a company can’t be as flexible as some employees wish. Observing duty of care responsibilities means that in some locations employees must stay in accommodation chosen by their company’s travel manager because it is the only safe choice available.

Booking behaviours – how travellers are booking their accommodation

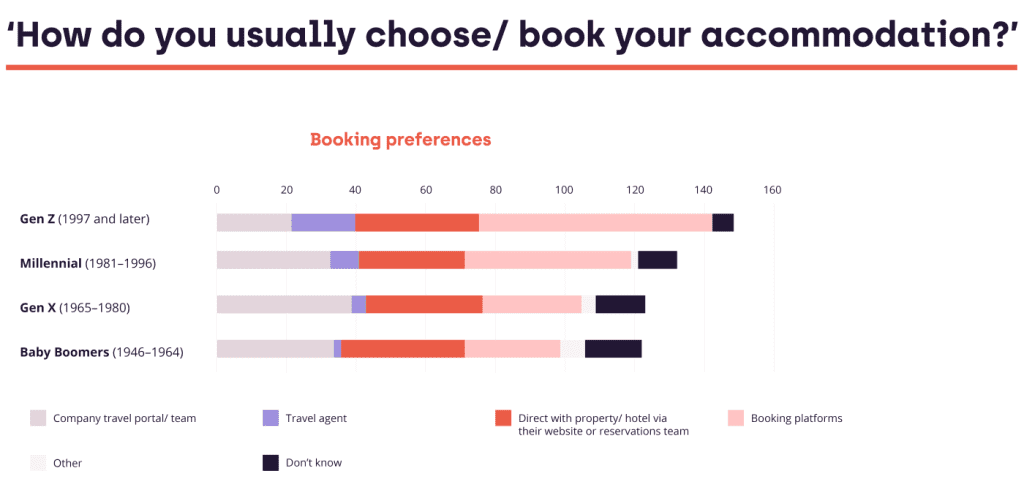

Survey respondents were then asked, ‘How do you usually book accommodation?’ – even if they were not responsible for choosing or booking it themselves.

The survey responses show that only 21% of Gen Z are using their company travel portal or travel team to book their business travel, while 38% of Gen X, 32% of Millennials and 33% of Baby Boomers report booking their business travel this way.

When it comes to popular commercial booking platforms, 66% of Gen Z and 47% of Millennial survey respondents are using these to book accommodation, compared to 28% of Gen X and 27% of Baby Boomers.

The percentages of survey respondents who are booking directly with properties via a website or reservation team are similar across all generational cohorts, although substantially more Gen Z book through a travel agent than any other generation.

Where do Gen Z stand out with their travel behaviours?

Insights from our interviews suggest that Gen Z are either not travelling much, are doing short stays in urban centres; or in some sectors, are out in the field in suburban or rural areas. Interviewees made the point that sometimes employees are forced to use generic booking platforms due to lack of accommodation in more remote locations. As a consequence, travel managers must then add the accommodation into the system after booking to ensure traveller tracking.

As digital natives, Gen Z want their booking power to be in their own hands for their stay of choice which seems to be tracking towards non-hotel accommodation, including serviced apartments and short-term rentals.

The drive for technology advancements in the accommodation sector

Advancements in booking technology are eagerly anticipated by those travel managers and travel programme designers we interviewed: having quality, non-hotel accommodation easily bookable for all travellers in the same place as hotel accommodation was a priority, not least in terms of compliance and duty of care.

Occasionally, employees themselves are tempted to try to book on commercial platforms, feeling they can ‘get it cheaper’. The use of online booking platforms makes verifying the quality of accommodation more challenging, as well as complicating the fulfilment of duty of care requirements. When travellers of any age are using such platforms, they may be at increased risk.

Wayne Lappage (Senior Buyer-Procurement Director, Yunex Traffic; ITM Member) makes the point that his team is comfortable with technology, and travellers at Yunex Traffic already want to book using AI. Team members, especially Millennials, want it to remember their preferences and previous choices and to be able to book all types of accommodation in one engagement.

Lappage says, “Our younger engineers, the Millennials, they want to book their trip via an app… they want to use the technology that’s available.” He goes on to say that employees know that AI can learn their preferences, and that they don’t want to be putting the same information in every time. They want AI to give them tailored recommendations, they want AI to say whether it’s in policy or not, “and they want it done seamlessly.”

A desire for increased agency and personalisation are the broad themes to come out of this study: values that are reflected in the means of booking accommodation as well as the demand for flexibility in accommodation choice. These values are visible to varying degrees in the different age groups – but are especially prevalent in younger generations.

We hope you have found these insights useful: stay tuned for the next instalment of Situ’s White Paper Insights series. Do get in touch with our Account Management team if you would like to discuss any aspect of the research study: [email protected]

[1] All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,145 adults, of which 554 are working adults who reported taking part in business travel. Fieldwork was undertaken between 27th–28th May 2025. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+)